5 Min Read

Is It Cheaper to Build a Custom Home or Remodel?

Recently I encountered an interesting study on the real cost of home ownership. I’ll look at the data below, but suffice to say I found it quite interesting, because it reminded me of the main reasons my wife Missy and I purchased our 1893 Victorian home; then ultimately decided to build a new ICF home.

You may have the same idea we did, asking yourself: Is purchasing and renovating a home right for me? Is purchasing and remodeling a home cheaper than building new? How much would hiring a custom home builder cost? It sounds simple: purchase an existing home with good bones, then make the necessary improvements and upgrades so that it is perfect for your family. After all, energy and health upgrades are much easier when doing a major renovation. The walls are already getting opened up, windows moved, HVAC changed, and so on.

Or maybe you are well into a renovation, and realizing how far you have to go. If this is you, you’re probably asking yourself some variation of: Can I afford to keep living in this home? Or: Can I afford to finish my home?

Setting the Stage: Owning an Older Home

While owning our classic home for about 10 years, my wife and I made significant energy efficiency, health, and comfort upgrades; such as Energy Star windows, spray foam attic encapsulation, 4” of insulation under the floors, and radiant heat.

We also made the home far more functional, remodeling almost every room, adding a bath and 2 bedrooms in the attic, pouring a slab in the basement, relocating the main floor laundry, etc.

Finally, we performed much needed maintenance, such as the aforementioned windows, a new roof, removing a dilapidated woodshed turned garage, replacing broken and sunken porches, upgrading the wiring and plumbing, and replacing both the well and the heating system.

After all that work, our heating bills were down to $2,809 for the winter of 2011-2012. That was around 700 gallons of fuel oil to “heat” 2,500 sq.ft. (to the mid 60’s during the day for those interested). Not exactly cheap, and not exactly clean. You don’t want to know what they were before all our improvements!

In other words, we experienced the full cost of owning an older home.

The continual increase in the cost of heating oil was a major factor. That was just a LOT of $$ for our young family. But I also realized our maintenance and improvements were nowhere near complete. We still needed to re-side the home, replace some exterior doors, repair the foundation, and on the list went. That’s not even considering improvements such as adding air conditioning, remodeling the kitchen, and building a garage.

Cutting our Losses, or Investing in the Future?

Missy and I simply took a look at the math and knew deep down: as much as we love this home, we simply cannot afford to continue living here.

We wondered: will our maintenance and improvement budget significantly drop if we build a new ICF home? After all, most of these expenses would be elective! That sounded like a dream come true compared to the nightmare of our old farmhouse home filling up with smoke one December day the furnace gave out, the temperature was dropping, and we had guests celebrating Christmas! Or that time I was working out of town when the well decided to kick the bucket. The decrease in stress alone was worth a fortune, but the lower budget would allow us to defer that income towards our mortgage—and build equity in the process. At least, that was the hope.

Another benefit would be our lower energy bills, again allowing us to use the money we would normally have put towards filling the fuel oil pig in the basement toward a more functional home.

The icing on the cake was the fact that the whole home would work for our family. There weren’t future modifications needed. No too large or too small rooms, awkward hallways, or scattered kitchen countertops. This home we would build would be nothing more and nothing less than what we needed. I don’t think there is a way to put a price on this, but I can tell you a well-designed custom home by a custom home builder is so much more valuable than forcing some existing home to work for your family.

Oh, there were other reasons too; like putting my money where my mouth is! R-Value had been building ICF homes for our clients 10 years by then, but I still had to experience living in one. “If they are so great, why don’t you have one?” Maybe nobody said that, but they could have….

Our Math: Is Building a Custom Home worth it?

We sold the Victorian and built our new ICF home for an additional investment of $150,000. Yes, it is also a larger home. But even with that aside, what did the extra $150K get us?

Remaining in the old home for an additional 15 year would have cost:

- $40,000 to reside and insulate the home

- $20,000 for foundation repair

- $35,000 more for heating costs

- $30,000+ kitchen remodel

- $30,000+ ongoing maintenance—trust me

At the end of those 15 years, we would still have an old home with sub-par energy bills, unhealthy air, no AC, and it wouldn’t work well for our family. And as you can see, we would have spent more than the $150,000 on maintenance and energy costs.

The Study: Average Home Expenses

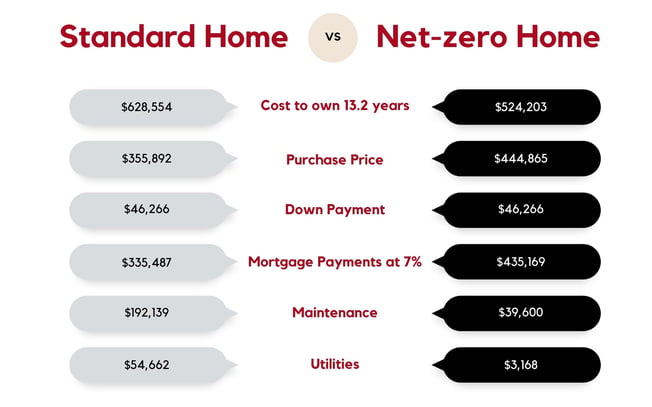

Self, a credit building company, looked at the real cost of home ownership. They considered the average length of time a person stays in a home (13.2 years for you trivia buffs), and average expenses over that timeframe.

- $566,930 Cost to own 13.2 years

- $355,892 Purchase price

- $46,266 down payment

- $270,593 Mortgage payments at 5%

- $192,139 Maintenance

- $54,662 Utilities

If these same homeowners built a similarly sized net-zero home, the additional cost might be 25%. (Remember we are comparing to existing homes. The additional cost is much lower when comparing to a new custom home). Here’s how those numbers look:

- $439,657 Cost to own 13.2 years

- $444,865 Purchase price

- $46,266 down payment

- $350,623 Mortgage payments at 5%

- $39,600 Maintenance (mostly yard maintenance)

- $3,168 Utilities (mostly service fees)

What is striking about this is how in the first example, the cost to own was higher than the purchase price, while for the net-zero home the cost was lower. In fact, the difference between the two is striking--$127,273! That amounts to over $800 less every month.

Now imagine that over 30 years! In 30 years, it is unlikely a well-built custom home by a custom home builder will need significant repairs. Metal roofs last a lifetime, maybe the HVAC will need a $10,000 replacement in that time, but contrary to popular belief, the solar panels will be fine.

Granted, the mortgage rate is lower than today. But on the other side, the cost of energy is up, and going up more all the time.

Here are the numbers at 7%:

Even in today’s higher interest environment, the net-zero home outshines, saving owners $660/month. The bottom line is that an investment in a low-maintenance, net-zero home is a very wise investment; even though it means borrowing more at a higher interest rate.

The cost savings are one thing, but not having to spend your evenings and Saturdays repairing your home is priceless.

Does purchasing and remodeling a home cost less than building new? Not if all things are equal. If equal utility, efficiency, health, and sustainability are factors, then building new is a lower cost, a shorter timeframe, and less stress.

Is renovating an existing home right for me?

It could be. But buyer beware. The end result is limited by what you are starting with. If you identify with the high cost of ownership or the frustration of endless marginal improvements, a durable and energy efficient custom home may be right for you, especially if you are weighing that choice against R Value Homes’ ability to take on smaller renovation projects that help bridge the gap between maintaining an older home and building new.

Can I afford to finish and keep living in my home?

- Start by listing all the repairs, improvements, and larger maintenance items you forsee making in the next 15 years. Remember to include the ones that should be done too (even if you might choose to defer these costs).

- Add in the cost of maintenance that you can reasonably expect to be lower in a new home

Multiply by a factor of inflation. Consider that inflation in the building sector was over 40% in the 18 months following 2020. - Add all these together, with the value of your home. That is what you could spend to build a custom designed new home, that would deliver far more in terms of resilience, sustainability, health, efficiency, comfort, durability, and utility.

Building a Custom ICF Home in Michigan

The guidelines above are a great place to start. Creating a new custom ICF home in West Michigan is a major investment; but one that pays dividends over the years by providing the comfort, stability, and quality of life you desire for your family. Still, you want to be confident you are making the most of your investment. R Value proudly serves West Michigan as the area's premier ICF contractor. Contact us to schedule a brief call to discover if building or renovating is a better option for you.